Factum Perspectives: Breaking down The Pandora Papers

By Chamara Sumanapala

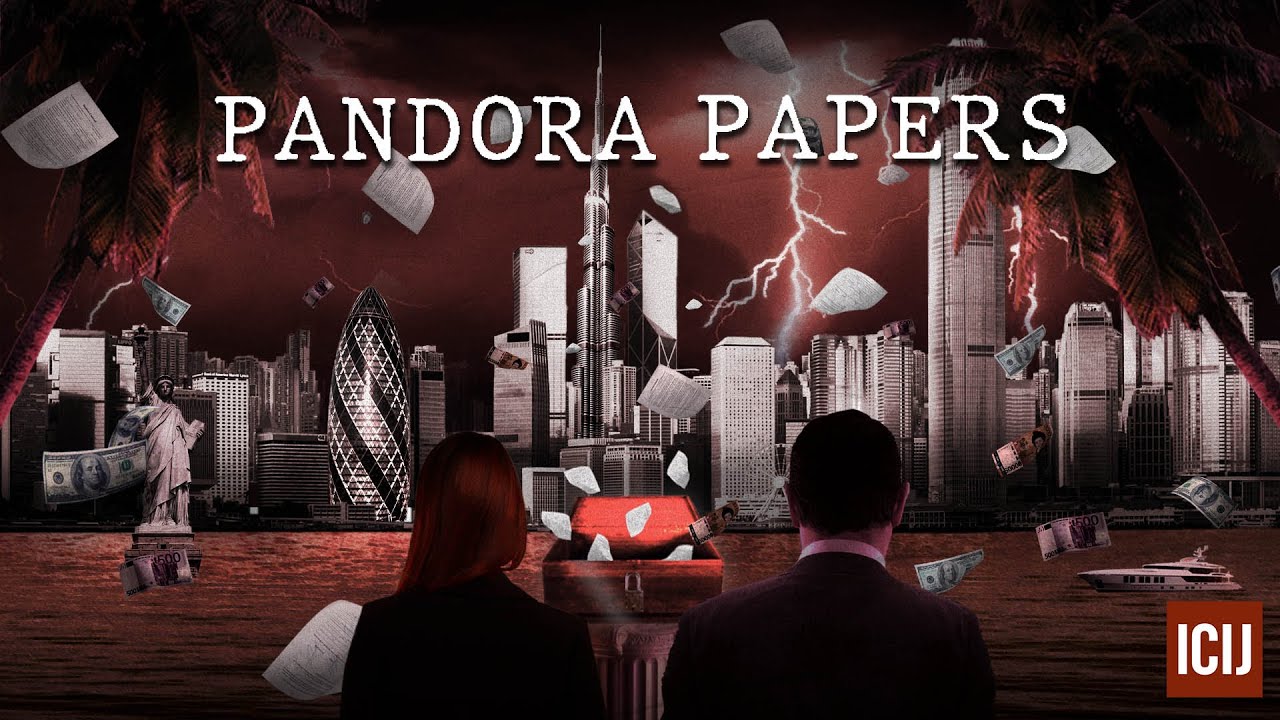

Before October 3 this year, most of us had heard about only one Pandora. The Greek mythology character that opened up a box and released all the vices that are present in the society. On October 3, another Pandora made headlines – a collection of documents carrying financial details named “Pandora Papers” published by the International Consortium of Investigative Journalists (ICIJ).

The ICIJ had “obtained more than 11.9 million financial records, containing 2.94 terabytes of confidential information from 14 offshore service providers, enterprises that set up and manage shell (cover up or shadow companies) companies and trusts in tax havens around the globe”. ICIJ says that it shared the files with 150 media partners, launching the broadest collaboration in journalism history. For nearly two years, they led an investigation into these documents with 600 journalists across 117 countries including Sri Lanka taking part in this massive effort.

The ICIJ was previously known for the Panama Papers which made similar exposes but it referred to the Pandora Papers as “the most expansive leak of tax haven files in history”. In other words, Pandora papers are the leak of leaks.

The investigation reveals the secret deals and hidden assets of more than 330 politicians and high-level public officials in more than 90 countries and territories, including 35 country leaders. It also reveals the names of 130 billionaires in 45 countries including some celebrities.

What is the ICIJ?

The ICIJ is a U.S.-based nonprofit organization which says it has a “small but resourceful newsroom and a global network of reporters and media organizations who work together to investigate the most important stories in the world”. It boasts membership of “280 of the best investigative reporters from more than 100 countries and territories” and partners with more than 100 media organizations including the BBC, the New York Times, the Guardian and the Asahi Shimbun, to small regional nonprofit investigative centers. Founded in 1997 by American journalist Charles ‘Chuck’ Lewis, ICIJ was launched as a project of the Center for Public Integrity and became a fully independent news organization in 2017.

What are tax havens and Shell (cover up or front) Companies)?

A tax haven is a country or a territory with low or no corporate taxes that allow outsiders to easily set up businesses. Tax havens also typically limit public disclosure about companies and their owners and as a result are referred to as secrecy jurisdictions.

Tax havens are found in many parts of the world ranging from independent countries such as Panama or territories such as the Cayman Islands and some states in the US. Some countries and territories have tightened their grip on tax havens over the years due to international pressure but there are numerous tax havens to this day regardless. Countries become tax havens mainly because of the money and charge a significant fee from the people who use their services.

A shell or a cover up company is a legal entity created in a tax haven. The term “offshore company” is also used to describe such an entity. As the name suggests, this is typically a “shell” without substance that may operate with an address without a permanent staff base or office space. The ICIJ in its expose mentions one such incident where a certain building in the Cayman Islands was home to 19,000 shell companies. The actual owners of many shells are not disclosed in its incorporation documents. Shell companies are easy to set up and can happen via a simple email but carry millions of dollars in value. Entities facilitating the registration of shell companies do so at a fee.

Are shell companies illegal?

Setting up a shell company is not necessarily illegal but it depends on the legal framework which is applied for registration. Whether a citizen of one country can establish a shell company somewhere else may depend on the legal framework of his or her country. Anyone can set up a “shell company” in a low tax jurisdiction for a fee. There can be legitimate reasons to do this. Individuals with business dealings spanning multiple countries often set up offshore companies in tax havens to pool profits so they could avoid being taxed twice.

The activities become illegal if the profits made are not declared in the home country and qualifies as tax evasion.

Significance of Pandora Papers ?

Pandora Papers differs from its predecessor Panama Papers and the Paradise Papers which dealt largely with offshore entities set up by individuals and corporations respectively. The data in Pandora Papers have been leaked from offshore service providers that set up and manage shell companies and trusts in tax havens. They reveal how businesses are trying to adapt to the situation after initial revelations forced countries to be more vigilant about such practices.

Will Pandora Papers change anything?

Panama Papers resulted in some repercussions. In some countries, politicians lost power and credibility. New laws were introduced to address the revelations. Pandora Papers have once again created the same excitement and discourse, but it also indicates that those who use tax havens for tax evasion and financial games are getting creative. There would not have been the need for the Pandora Papers otherwise. This highlights that governments must become more creative and robust ahead of those misusing the system to tax evade, failing which more Papers will become a never ending cycle.

(Chamara is a journalist, writer, presenter and has a Bachelor of Science from the University of Colombo. His research interest are history and international relations)

***************

Disclaimer – Factum is a Sri Lanka based think-tank providing international relations analysis and public diplomacy consultancies in Sri Lanka and Asia. Visit – www.Factum.LK