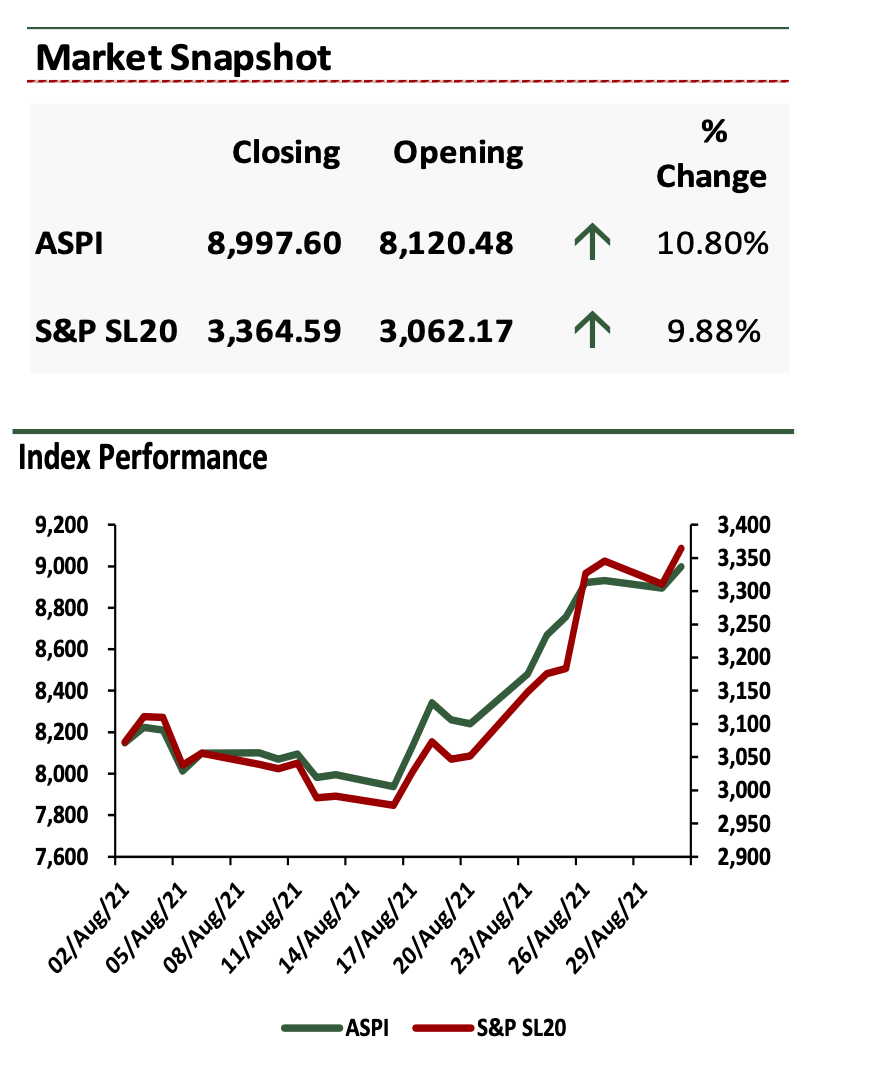

Market witnessed a volatile beginning for the month with negative sentiments prevail- ing over the spread of the Delta Covid variant. However, following the nationwide lockdown in effect from 21st August, the indices rallied upwards backed by sharp price movements in counters such as CLC, EXPO and LOFC. ASPI gained 10.80% to close at 8,997.60 and S&P SL20 gained 9.88% closing at 3,364.59. CSE’s market capitalization surpassed the LKR 4bn mark while the YTD turnover reached LKR 658.27bn which is the highest annual turnover figure since 2010 (LKR 570bn).

Investor interest was evident on EXPO, HAYL and LOLC with retailers rallying around counters such as CLC, BIL and LOFC. HNI and institutional participation was noticed in TILE and SDB. USD income generating counters gained interest particularly from the retail front with concerns over LKR depreciation.

Investor interest was evident on EXPO, HAYL and LOLC with retailers rallying around counters such as CLC, BIL and LOFC. HNI and institutional participation was noticed in TILE and SDB. USD income generating counters gained interest particularly from the retail front with concerns over LKR depreciation.

JAT Holdings Limited (JAT) commenced trading on the Main Board during the month. JAT has been classified under the Materials sector. SDB Bank shares from its secondary public offering (SPO) were also listed in the bourse. Following the SPO, Iconic Property Twenty Three Ltd., a fully owned subsidiary of LOLC Investments, has been allocated 24.1mn shares amounting to a 15% stake in SDB.

Turnover improves by 167% MoM

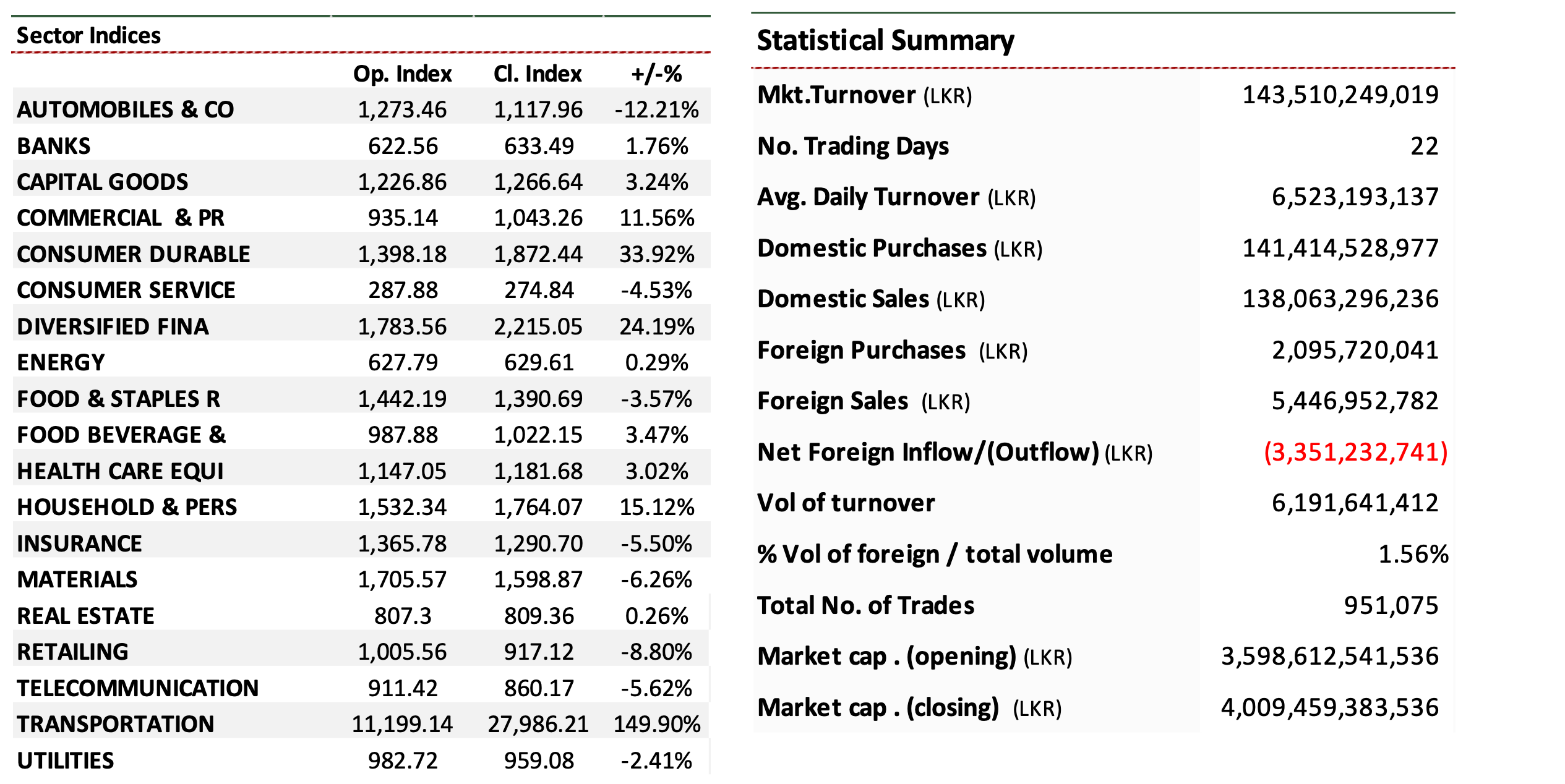

The market posted a turnover of LKR 143.51bn, averaging a daily turnover (22 trading days) of LKR 6.5bn improving from LKR 2.7bn posted in July. Turnover continued to be dominated by local play which contributed to ~97% of turnover. EXPO was the top contributor to turnover (~28%) and was among the highly traded stocks during the month (~6% of volumes) as the counter appreciated by LKR 100.75 (+150% MoM).

BIL and LOLC followed suit in terms of turnover contributing ~13% and ~6% respectively. Interest also continued to hover around HAYL, DIPD, RCL and LOFC which were among the top turnover list. BIL emerged the top contributor in terms of volumes (~35%) followed by SEMB(X) ~8%. LOFC, EXPO and ASPH were among other high volume counters during the month.

Foreigners continued to be net sellers

Foreigners posted a net outflow of LKR 3.4bn for the month, with foreign selling amounting to 4% of total turnover.

Sector gainers and losers

Transportation sector saw the highest gain of 149.90% following the price appreciation in EXPO while the biggest loss of 12.21% was seen on the Automobiles & components sector.