In the dynamic realm of construction in Sri Lanka, the year 2024 unfolds with a notable transformation in cost considerations for building houses. Despite unprecedented challenges, the sector is experiencing a positive shift, marked by controlled inflation, and eased import restrictions.

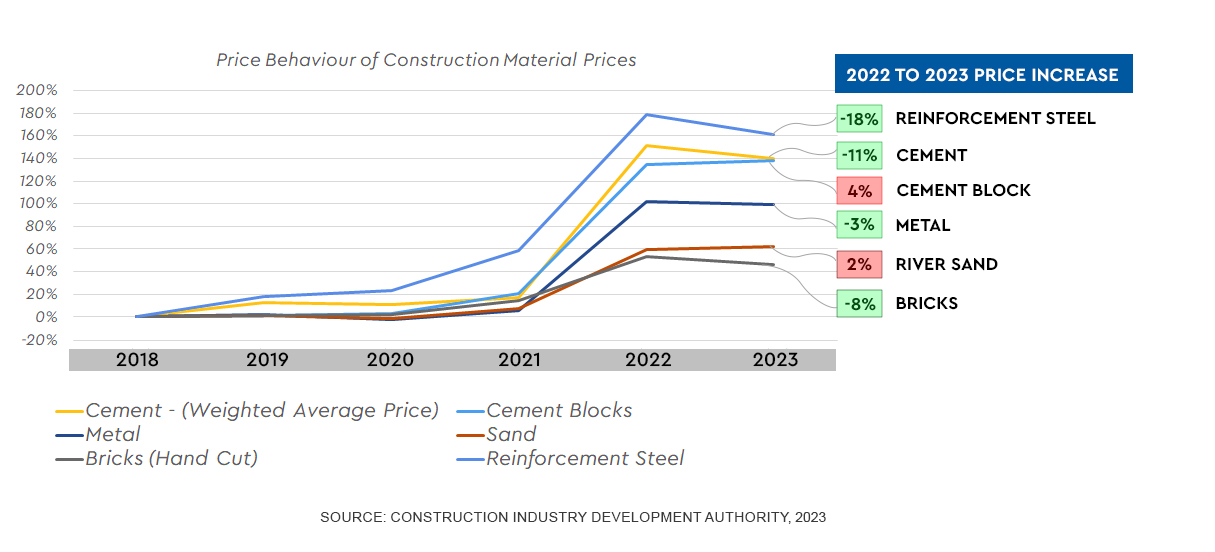

The trajectory of construction costs, which began escalating in mid-2022, encountered a noteworthy change in 2023. During this period, certain raw material prices witnessed a slight increase, while others exhibited a decrease.

Data sourced from the Construction Industry Development Authority highlights the nuances in price fluctuations. Notably, the average price of a 50kg cement bag, sold by both public and private dealers, increased by 4% from 2022 to 2023. River sand prices witnessed a 2% uptick during the same period. In contrast, reinforcement steel prices marked a significant 18% decrease, cement prices (weighted average) saw an 11% drop, metal prices decreased by 3%, and hand-cut brick prices registered an 8% decline.

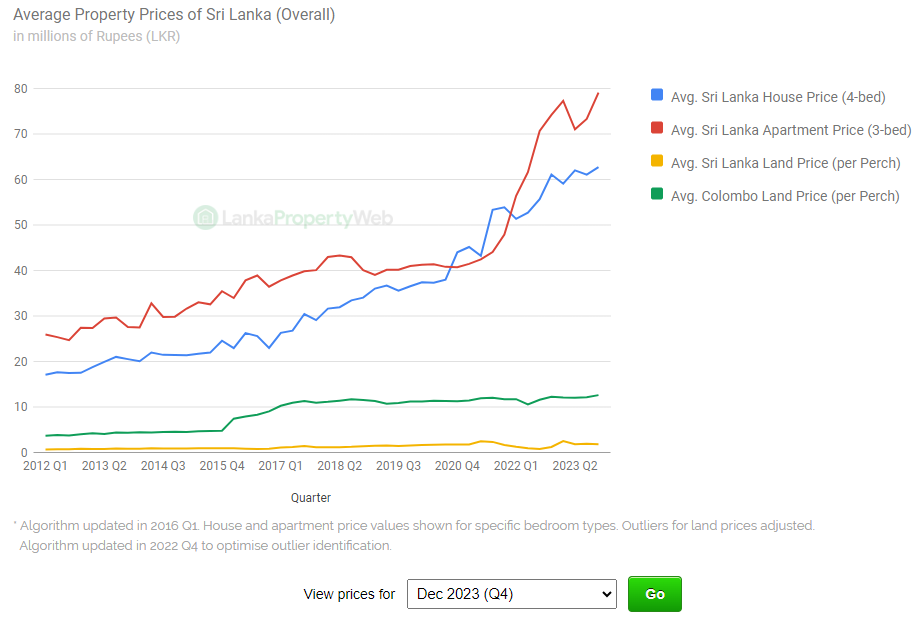

On the Real Estate side, the latest figures from the House Price Index of LankaPropertyWeb for Q4 of 2023 paint a nuanced picture. The average house price (4-bedroom) in Sri Lanka increased by 2.64% compared to Q4 of 2022 and the average apartment price (3-bedroom) in Sri Lanka increased by 6.59% compared to Q4 of 2022. Conversations with developers and real estate agents, facilitated by LankaPropertyWeb, revealed that these incremental price changes are primarily attributed to controlled inflation, eased import taxes, and fluctuations in the prices of select construction raw materials.

Average property prices according to the Sri Lanka House Price Index

The overall cost considerations for building a house in 2024 extend beyond material prices alone. Factors such as location, land and house size, design intricacies, architect/engineer fees, material choices, construction workforce, project duration, and basic furniture costs significantly impact the financial landscape for homeowners. This interconnected approach enables stakeholders to make informed decisions in navigating the complex considerations that shape the comprehensive financial outlook for building homes in Sri Lanka.

The size of a house is a defining factor in determining its cost. Aspirations for spacious holiday properties, like villas or bungalows, may range between Rs. 150-900 Million. On the other hand, smaller-sized dwellings such as annexes or modest single-family houses can be more budget-friendly, hovering around Rs. 3-5 Million for those prioritizing efficiency over ample space. According to the research carried out by LankaPropertyWeb (LPW), the average cost per square foot for a basic house stands at approximately Rs. 20,000/= as of January 2024 (an increase from Rs. 15,000 in January 2023 and Rs. 12,000 in January 2022), while luxury fittings and modern conveniences elevate the cost to around Rs. 30,000 per square foot and beyond.

The architectural design selected for a house is a pivotal factor influencing its overall cost in the dynamic Sri Lankan real estate market. A traditional box-shaped design, focusing on essential facilities, may incur costs around Rs. 8 million, while a more modern, intricately designed house could reach up to Rs. 600 million as of 2024. Notably, adapting to the challenges posed by fluctuating raw material prices and shortages in 2022, house builders in Sri Lanka have adjusted construction costs per square foot to align with the evolving landscape of construction expenses.

The fees levied by architects play a significant role in shaping the overall construction cost of a house in Sri Lanka. The “SLIA Recommended Professional Fees and Conditions of Engagement” serves as a guideline for architects’ fees, offering insights into the amounts that should be charged. However, individual architects may vary in their charges, influenced by factors such as reputation and experience. Typically, these fees fluctuate from 1% to 8% of the overall house construction prices in Sri Lanka. Alternatively, designers may adopt a square feet basis, charging between Rs. 20-100 per sq ft, and around Rs. 2000-5000 per visit.

In the intricate process of house construction, the choice of materials holds significant sway over the overall cost. As of 2024, essential construction materials present varying costs, with bricks ranging between Rs. 30-40, cement blocks Rs. 70-90, roof tiles Rs. 70-100, and a 50-kilogram sack of cement priced between Rs. 1900-2300. However, embracing innovative materials, such as studio units crafted from shipping containers, can offer cost efficiencies, with construction expenses potentially ranging from Rs. 1-2 Million.

In 2024, the compensation landscape for construction workers in Sri Lanka reflects varying rates, with unskilled workers earning around Rs. 60,000-70,000 per month, while skilled counterparts command approximately Rs. 100,000-120,000. The pivotal role of labor in construction is evident, as the number of workers engaged, and the project duration can markedly influence the overall construction cost of a home.

In the pursuit of creating a truly complete home, attention to detail becomes paramount. Beyond the usual tasks of painting and installing light bulbs, it’s crucial to recognize that the inclusion of essential furniture and home appliances is integral to the project’s completion. Furniture items such as sofa sets (costing between Rs. 100,000-300,000), chairs (Rs. 6000-10,000), tables (Rs. 50,000-100,000), cupboards, wardrobes (Rs. 50,000-180,000), beds (Rs. 25,000-200,000), among others, bring the finishing touch that transforms a construction project into a comfortable and fully functional home.

As we navigate the evolving landscape of construction costs in Sri Lanka, the positive changes witnessed in 2023 reflect the resilience and adaptability of the industry. With controlled inflation and eased import restrictions, stakeholders are empowered to make informed decisions, fostering a promising outlook for the construction sector. The industry’s ability to navigate challenges and embrace transformation positions it for a future marked by sustainable growth and innovation.