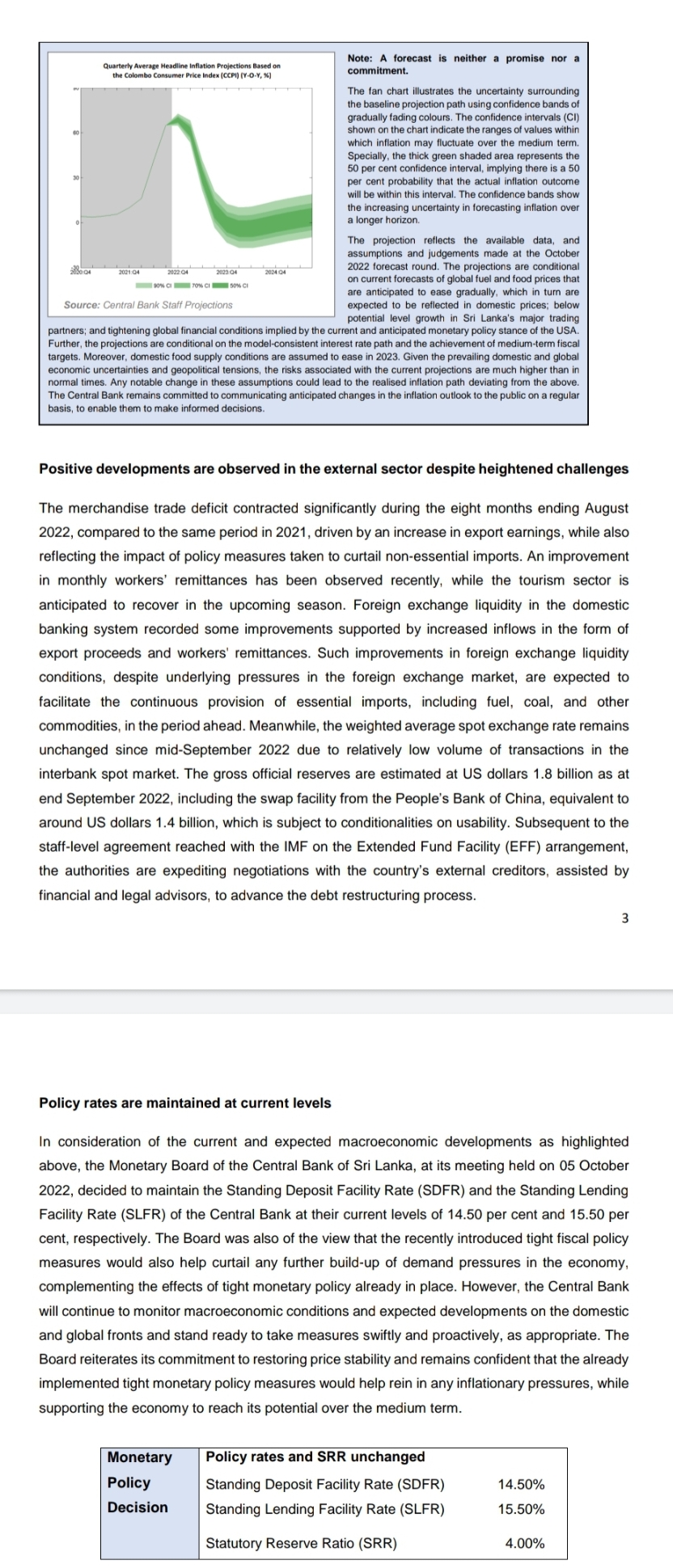

The Monetary Board of the Central Bank of Sri Lanka (CBSL) has decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at their current levels.

The CBSL said that Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) have been maintained at their current levels of 14.50 per cent and 15.50 per cent, respectively.

The decision had been taken at the CBSL Monetary Board’s meeting held on Wednesday, 05 October 2022.

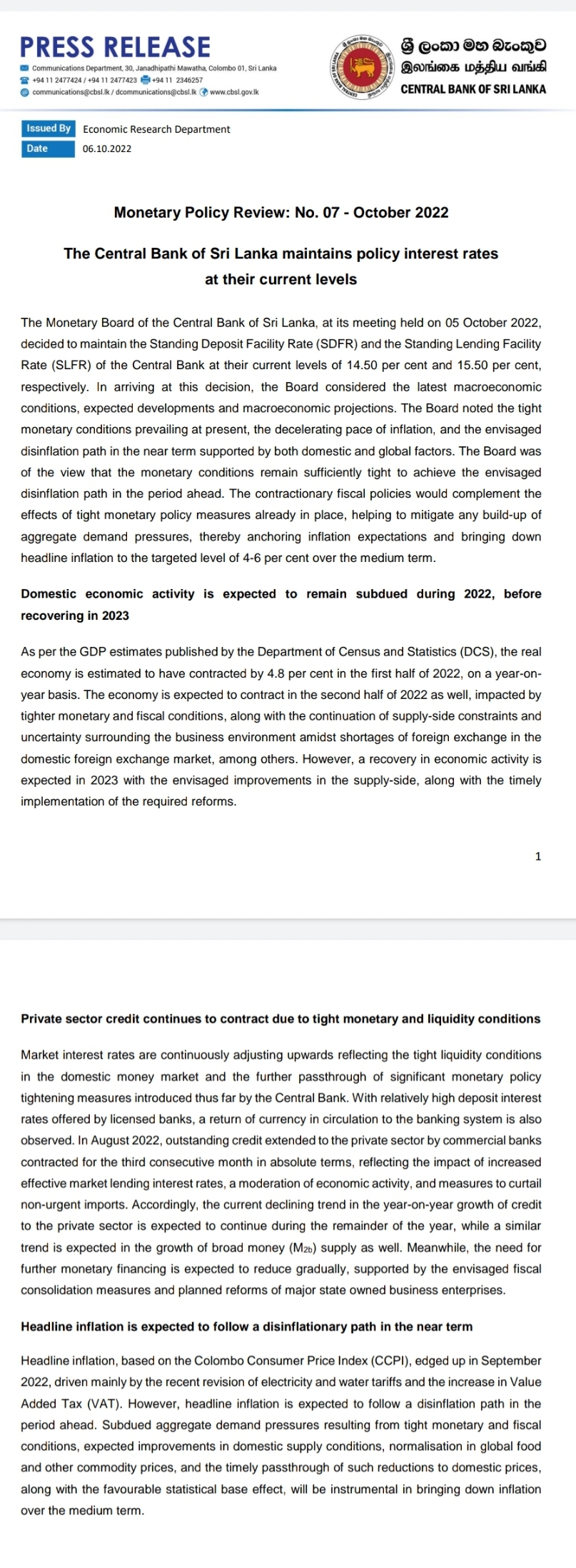

In arriving at this decision, the Board considered the latest macroeconomic conditions, expected developments, and macroeconomic projections. The Board noted the tight monetary conditions prevailing at present, the decelerating pace of inflation, and the envisaged disinflation path in the near term supported by both domestic and global factors.

The Board was of the view that the monetary conditions remain sufficiently tight to achieve the envisaged disinflation path in the period ahead. The contractionary fiscal policies would complement the effects of tight monetary policy measures already in place, helping to mitigate any build-up of aggregate demand pressures, thereby anchoring inflation expectations and bringing down headline inflation to the targeted level of 4-6 per cent over the medium term. (NewsWire)