An economic expert has warned that the lack of sufficient foreign assets in the banking system will disrupt the repayment of short-term liabilities.

Former Deputy Governor of the Central Bank of Sri Lanka (CBSL) Dr. W.A. Wijewardena said at present the Central Banks’ own obligations in foreign exchange have become larger than the foreign assets.

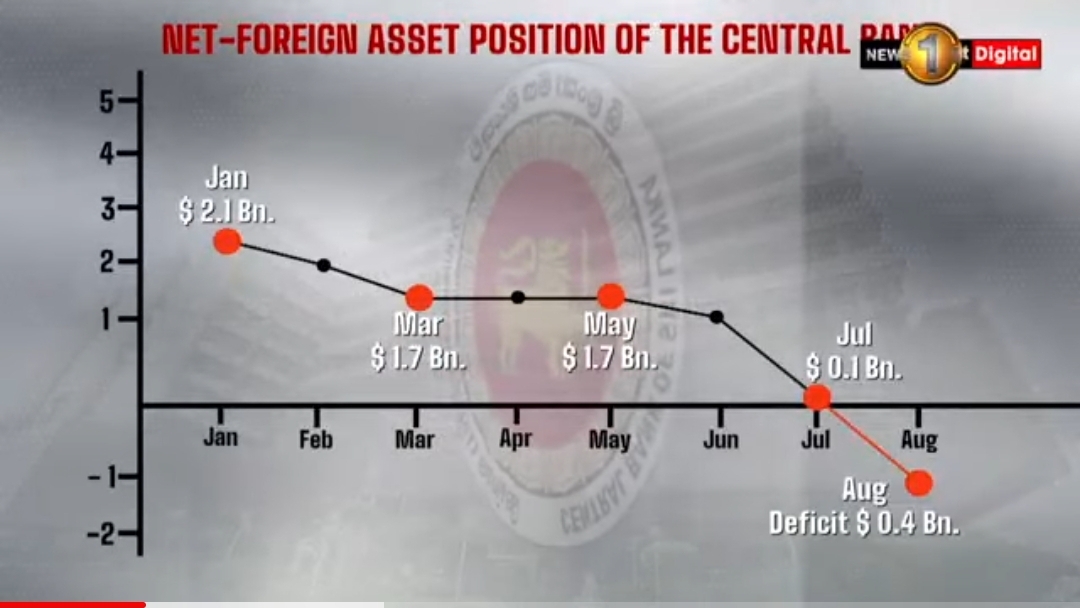

His comments come after the Central Bank reported a deficit of Rs. 83.9 billion in its net foreign asset position by the end of August 2021.

The net foreign asset position of the banking sector also declined from a deficit of UD$ 1.6 billion in January 2021 to a deficit of US$ 3.5 billion by the end of August 2021.

Central Bank Governor Ajit Nivard Cabraal, commenting on the matter during a media briefing held yesterday, said that the position of net foreign assets being in the negative is a temporary situation.

He pointed out that this situation can change with one transaction, such as a SWAP within the next few weeks and so on. (NewsWire)